Texas Legislators File 12 New Right to Refuse Bills!

The Texas legislature meets every two years for a 140-day marathon of working to pass new bills. For 2023, the lawmakers will convene their 88th Session on January 10, and at least twelve right to refuse bills have already been introduced for consideration. As with many other states, different legislators are trying many different approaches to protecting citizens’ rights. One broad bill is HB1032. Under this proposal, employers and insurers may not discriminate based on COVID-19 vaccine status. And, primary, secondary, and higher education students may not be required to receive COVID-19 vaccine.

Existing Law Offers Some Protection

Under SB968, which became law on June 16, 2021, Texas government entities and businesses are not allowed to issue or require any vaccine passport or other documentation regarding COVID-19 vaccination status.

Protection for Compelled Vaccination, Students, and Medicaid Patients

SB177 and its companion HB81, are entitled the Texas COVID-19 Vaccine Freedom Act. This Act states that no person may compel another to accept a COVID-19 vaccine contrary to the person’s preference. Health care providers may not administer COVID-19 vaccines without informed consent. And no person may take adverse action against another for refusal of COVID-19 vaccine. The Attorney General may bring an action for violation of this law. Bill HB777 would prohibit face covering mandates for public school students and prohibit public schools from requiring students to provide documentation regarding COVID-19 vaccination. HB44 and companion bill SB303 would preclude discrimination against a Medicaid recipient, or child health plan program enrollee, based on immunization status.

Health Commission Authority, Discrimination

Bill HB807 removes the authority of the health commission to add to listed vaccines required for school attendance. It also removes the emergency authority to override conscientious objections to vaccinations and states that government entities may not require vaccines not listed. SB304 would mean that public accommodations, long-term care facilities, health care facilities and providers, insurers, government entities, and employers may not discriminate based on vaccination status or immunity status. And schools must exempt student from vaccinations with affidavit from doctor or parent who objects for reasons of conscience.

Strict Consent Requirements

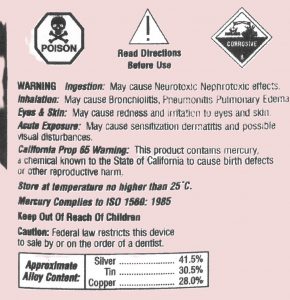

Under SB305, prior to any vaccination, the provider must advise of the benefits and risks, including any vaccine information statement required by the National Childhood Vaccine Injury Act. Providers must record any serious health problems following vaccination and make a report to VAERS. No sanctions are allowed for a health care worker who writes medical exemptions, and medical exemptions shall be accepted. Similarly, SB298 states that health care providers shall provide information on risks and benefits of immunization including any vaccine information statement required by the National Childhood Vaccine Injury Act, and the Vaccine Excipient Summary published by the CDC. Providers are liable for any harm incurred from vaccination without proper consent procedures.

Businesses Liable for Vaccine Injury, Eligibility for State Funds

Two final bills are SB302 and HB1015. Under the former, employers who do not accept exemptions for medical or conscientious reasons are liable for any damages caused by a mandated vaccination. The latter states that any business which requires customers, employees, or others to receive a COVID-19 vaccine is not eligible for any state grant funds or state contracts.

Now more than ever it is important that we use the tools that are available to us as Americans.

Your donation makes a huge difference in our ability to educate, foster, and mobilize with people like you in states across the country.

Together we can create the laws “we wish to see in the world.” Laws that protect our rights to make choices about our own health and the health of our children.

Donate by Credit Card, Paypal or by mail

NHFA is a 501(c)4 lobbying organization, therefore your donations are not tax deductible.